9 March 2021

There’s been plenty of M&A deal talk and activity in the market recently. Among others, we saw the Aviva Singlife merger deal close in Singapore, China’s Tencent raised EUR1.3bn via a club deal to increase its stake in Universal Music Group, and South-Korea’s SK Hynix secured from domestic banks USD3bn earmarked for M&A activity.

But is this segment of the loan market really experiencing a boom? We thought this is a good time to look into the numbers using the Analytics tools on the iLex platform.

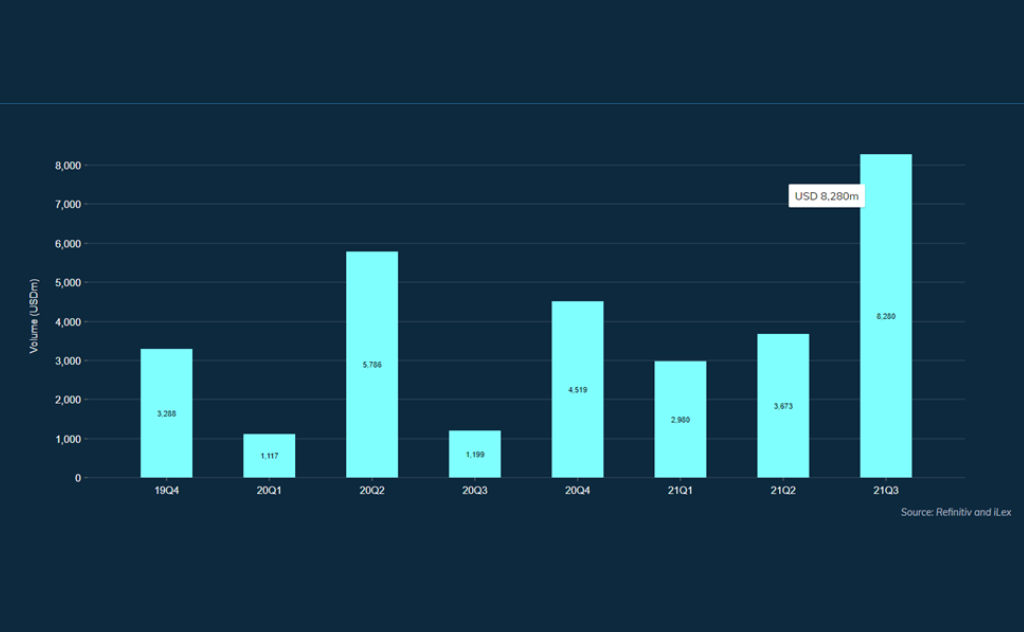

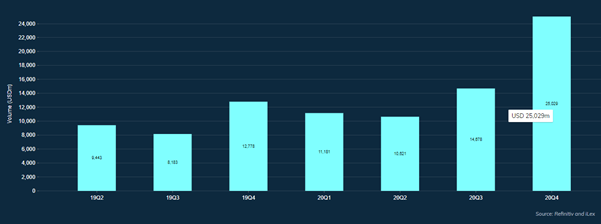

We found that our Acquisition Finance category made up 17% of all APAC ex-Japan volumes in 20Q4 with a total volume of USD25bn closed in that quarter, a marked increase from the previous quarters and the highest proportion in 2 years.

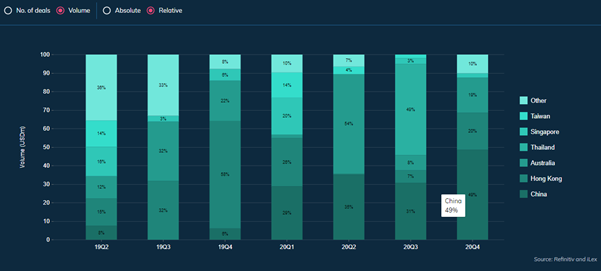

Also interesting to note, is the geographical make-up of the deals in APAC ex-Japan, with a significant increase in the proportion of deal volumes from China in 2020 compared to the previous year. Hong Kong and Australia follow, although Australia is much closer in terms of number of deals.

To gain your own insights into what’s happening in the loan markets and use iLex’s analytics to support deal flows, login here to the iLex platform now if you are a iLex Pro user or request for a demo here.