Get started

Speak to our team for a demo and join us in the future of loan markets

Transforming loan

capital markets

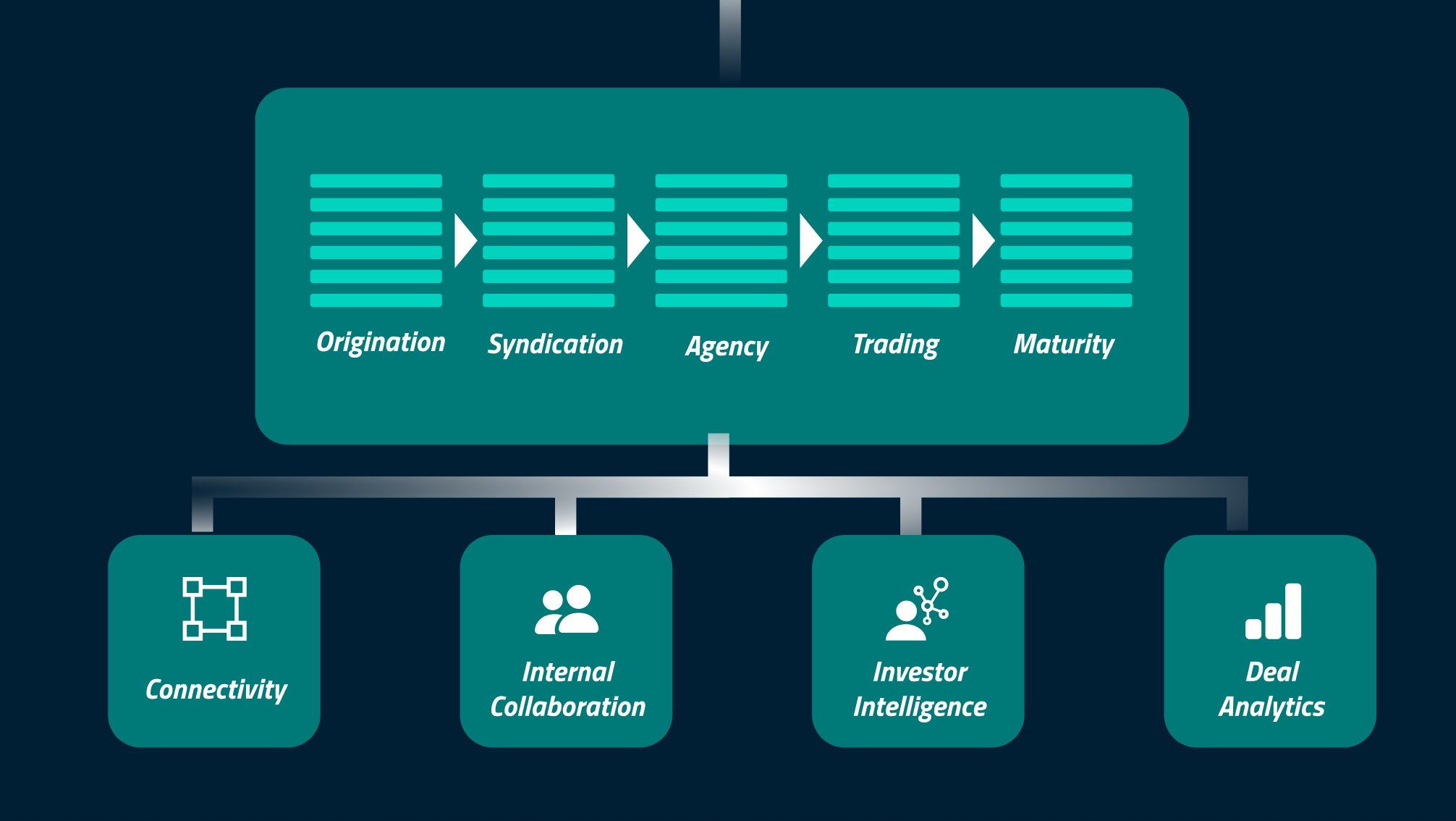

iLex is leading innovation in the loan market in close

collaboration with our partners through the use of advanced

technologies, artificial intelligence and smart data & analytics.

We are supported by an experienced team which is dedicated

to providing the best loan platform to our clients.

Latest news

Visit our content hub for our full library of news, blogs, announcements, updates and much more.