27 September 2021

Amid a global mergers and acquisitions (M&A) frenzy, Australia is certainly experiencing the same resurgence in activity, having clinched a new YTD record in M&A volumes back in early August with an impressive USD174bn, up more than 6x year-on-year. In this article, we use iLex’s Market Analytics tools to take a closer look at this segment of the loan market, as well as opine on how this bubble of activity could just be the right time to future proof the syndication process.

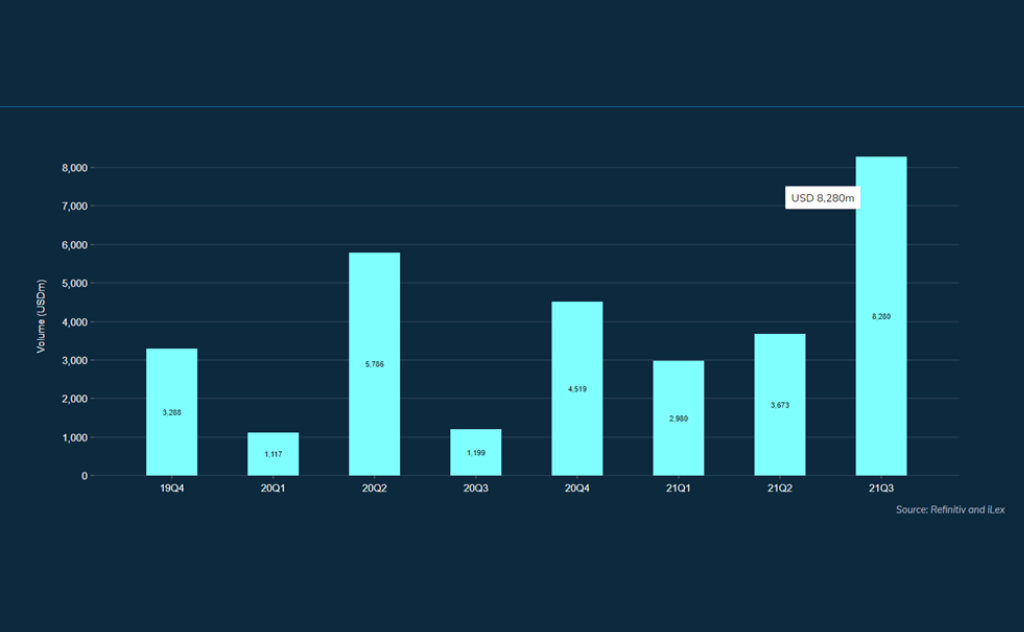

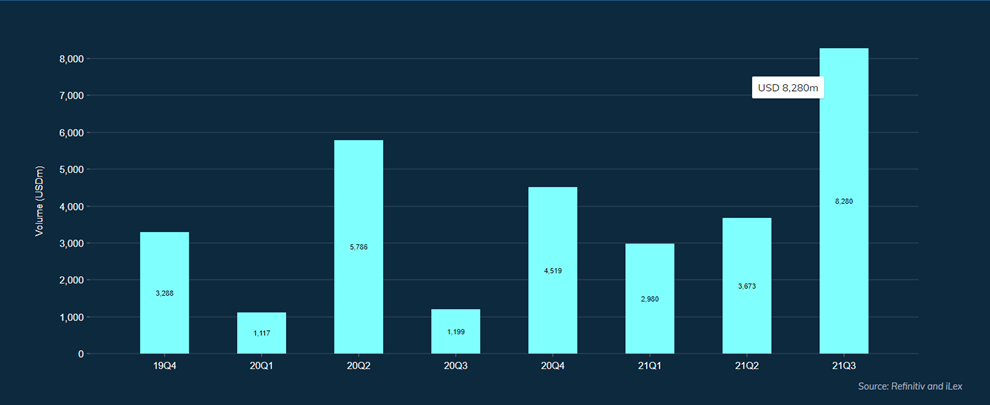

Filtering for Australia and Acquisition Finance in Market Pulse, we found that the Refinitiv-reported cumulative volume of USD14.9bn for YTD2021 has already surpassed annual volumes for the past 5 years.

Interestingly, we observe a relatively low number of deals closed (6 deals) this quarter, signaling higher values of M&A deals.

The 5-year industry breakdown shows us that Consumer & Services is the leading deal segment, making up around 23% of volumes reported, out of which most volumes are from the Healthcare industry. The rest of the volumes come from Industrials (15%), Natural Resources (14%), followed by TMT, Real Estate, Infrastructure & Utilities and others.

The deals closed this quarter include Macquarie’s AUD1bn TLB/RCF backing its AUD2.3bn buyout of BINGO Industries, Towers Infrastructure’s AUD1bn TLA and ESR’s AUD2.2bn TLA/RCF.

The largest deal this year so far is Seven Group Holding’s AUD5.5bn bridge loan for the acquisition of construction materials maker Boral, but the door is open for refinancing transactions when the bridge loan is replaced by July.

Advisors have factored low absolute rates and high demand for assets into their modelling for these M&A deals. In this environment, we hear anecdotally about syndicators being very comfortable with the makeup of their lender groups. The last time M&A volumes were so high in Australia was in 2007 and risk management became the focus shortly after that record was achieved.

Adding iLex to the process now while arrangers have seemingly endless options plays an important role in establishing a network that will be useful once the froth settles and risk management becomes more nuanced. Those on the iLex platform will have contact with a broad universe of potential lenders and will be able to establish enhanced distribution as they go through internal processes, enabling more transactions to gain approvals. Using the iLex network not only facilitates selling down these boom-time deals to comfortable hold levels, it also builds new relationships that often have very diverse risk appetites.

To gain your own insights into what’s happening in the loan markets and use iLex’s analytics to support deal flows, login here to the iLex platform now if you are a iLex Pro user or request for a demo here.