25 May 2021

The property markets in the financial hubs of Hong Kong and Singapore have traditionally served as barometers of regional economic activity. Seeing various headlines pop up on our new iLex News screens, we decided to take a closer look.

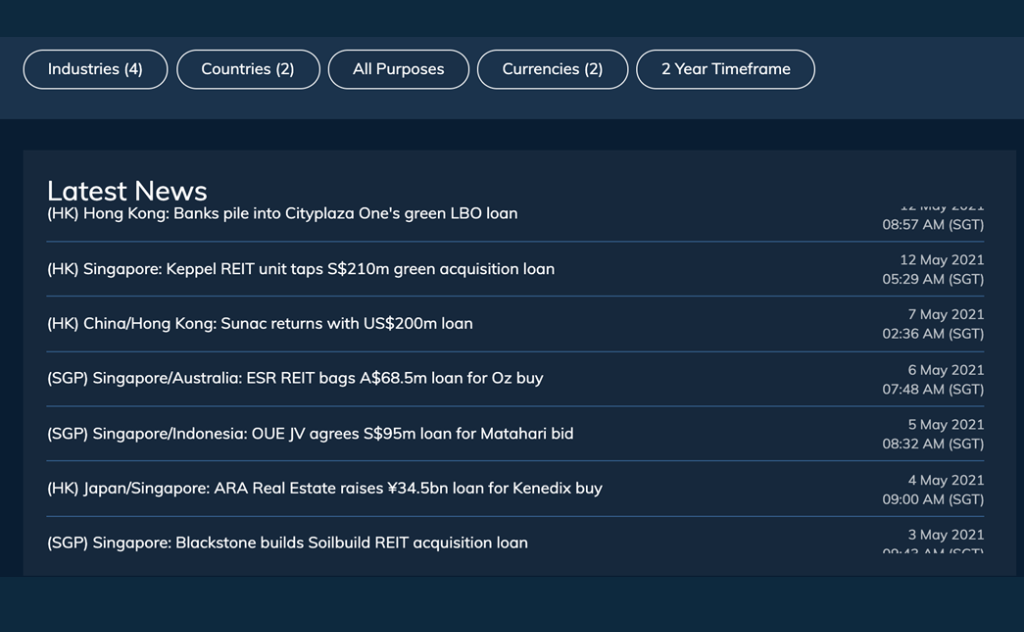

Filtering on our four Real Estate related industries and just those two countries and their currencies, we indeed see plenty of deal related news headlines in the last two weeks alone.

Several sponsor-led property acquisitions made the headlines including a green LBO loan for Cityplaza One in Hong Kong, a Keppel REIT acquisition green loan in Singapore and an ARA JPY acquisition loan.

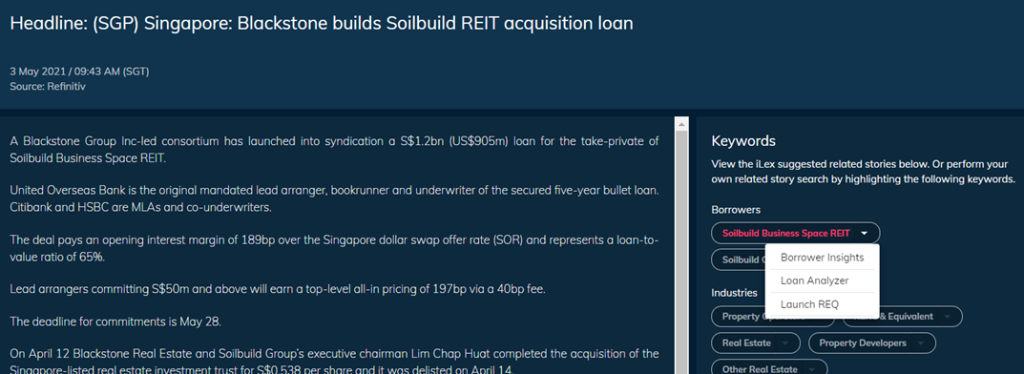

But the deal that piqued our interest was the SGD1.2bn (USD905mn) loan for the take-private of Soilbuild REIT by its executive chairman Lim Chap Huat and Blackstone.

The article, written by Refinitiv, mentions the arranger and co-underwriters. We can launch the iLex Borrower Insights tool straight from the news article to look at the lenders that have been most active in the Singapore REIT space over the last year.

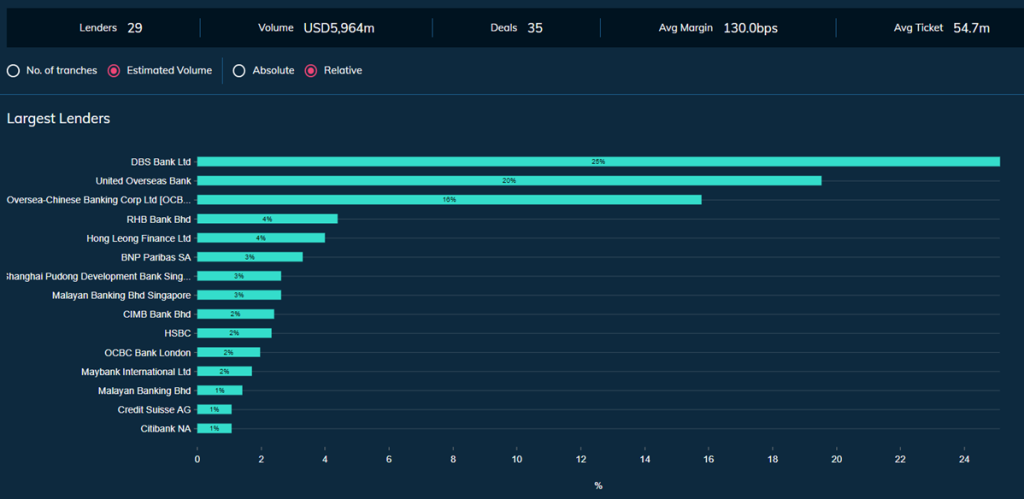

Not surprisingly, given the home market advantage, the three Singaporean banks still clearly lead the way, making up 66% of estimated volumes. Apart from some of the Malaysian banks, there are other Asian, European and US banks. Refer to the chart for those involved in Singapore’s REIT space.

To gain your own insights into what’s happening in the loan markets and use iLex’s analytics to support deal flows, login here to the iLex platform now if you are a iLex Pro user or request for a demo here.