29 October 2021

China’s real estate sector has come under pressure as several of its property developers face a liquidity crisis. Its largest and most indebted developer, China Evergrande Group, first warned of a potential default back in September of 2020, a month after regulators introduced the “three red lines” rules, which capped the amount of debt developers could take on and introduced limitations on refinancing. The group’s debt woes have since snowballed into nearly a formal default, with its upcoming bond coupon payments due creating a cliff-hanging situation.

A number of other highly leveraged developers are facing similar challenges such as Fantasia, which failed to repay some of its debt on 4th October 2021. The crisis has thrust underlying issues with China’s real estate sector into the spotlight once again – after years of developers’ credit-fueled growth and building up off-balance-sheet debt.

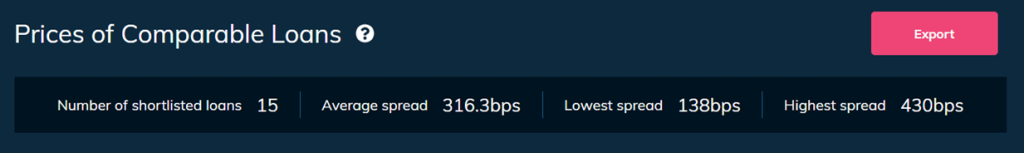

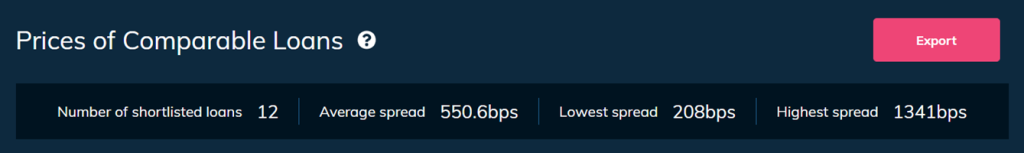

With many eyes currently focused on this sector, we head into iLex’s market analytics to have a look at the loan prices. Selecting a dozen Chinese high-yield property developers and shortlisting some of their loans made in the past 2 years, we note that observable spread quotes as of 27th October 2021 are, as expected, significantly wider than the original margins of the loans, with a median widening of ~110bps, which is a relative widening of approximately 41%.

Comparing the loans’ secondary quotes to their original all-in spread, the median increase is ~135bps or approximately a 35% widening. Amongst them, China Aoyuan Group’s HKD1.3bn Term Loan A loan was seen to have one of the largest spread widenings, doubling at one point from its original margin after the developer’s rating was downgraded from B+ to B by S&P.

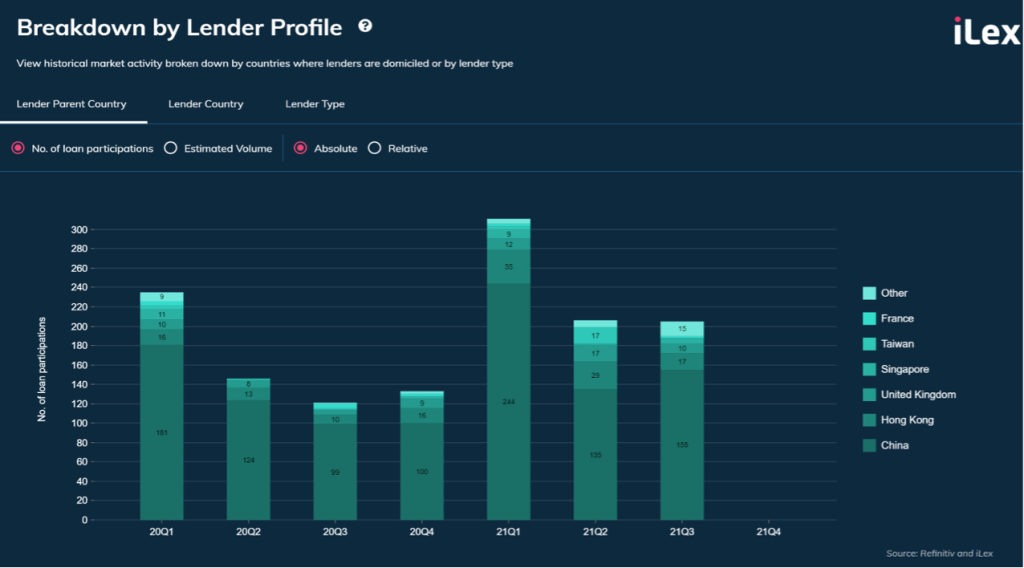

To look at where the impact of these woes might be most felt, iLex’s Borrower Insights shows that there are 55 different original lenders to the selected names’ offshore loans in the past 2 years. Unsurprisingly, the lenders with the largest exposures are Mainland Chinese and Hong Kong banks. However, we do spot original lenders also from the UK, Singapore, France and Taiwan, as shown by the chart below.

Given the regulatory constraints and the risks surrounding the sector, we believe there will be a significant reduction in business-as-usual refinancings coming out of this sector and, if we do see any, then margins are likely to widen for these HY developers. We are also likely to see corporate re-organisation events such as asset and equity stake disposals, M&A activity or debt restructurings.

To gain your own insights into what’s happening in the loan markets and use iLex’s analytics to support deal flows, login here to the iLex platform now if you are a iLex Pro user or request for a demo here.