The Next-Gen Platform

for Loan Distribution

Our comprehensive solutions for investor intelligence,

engagement and deal sites are integrated with

seamless uX and connectivity on one platform.

Why iLex

Universal

Primary, secondary, private

credit, clubs

All loan structures

All geographies

Modern

Intuitive and interactive user

interface

Built-in productivity and

collaboration tools

Progressive integration of LLM

and chat bots

Data-enabled

Open-source data model

Advanced deal and investor

analytics and insights

Superior data lineage

throughout the lifecycle

Integrated

Comprehensive suite of

solutions all in one place

End-to-end workflow and data

automation

Unique open architecture and

API gateway

Universal

Primary, secondary, private

credit, clubs

All loan structures

All geographies

Modern

Intuitive and interactive user

interface

Built-in productivity and

collaboration tools

Progressive integration of LLM

and chat bots

Data-Enabled

Open-source data model

Advanced deal and investor

analytics and insights

Superior data lineage

throughout the lifecycle

Integrated

Comprehensive suite of

solutions all in one place

End-to-end workflow and data

automation

Unique open architecture and

API gateway

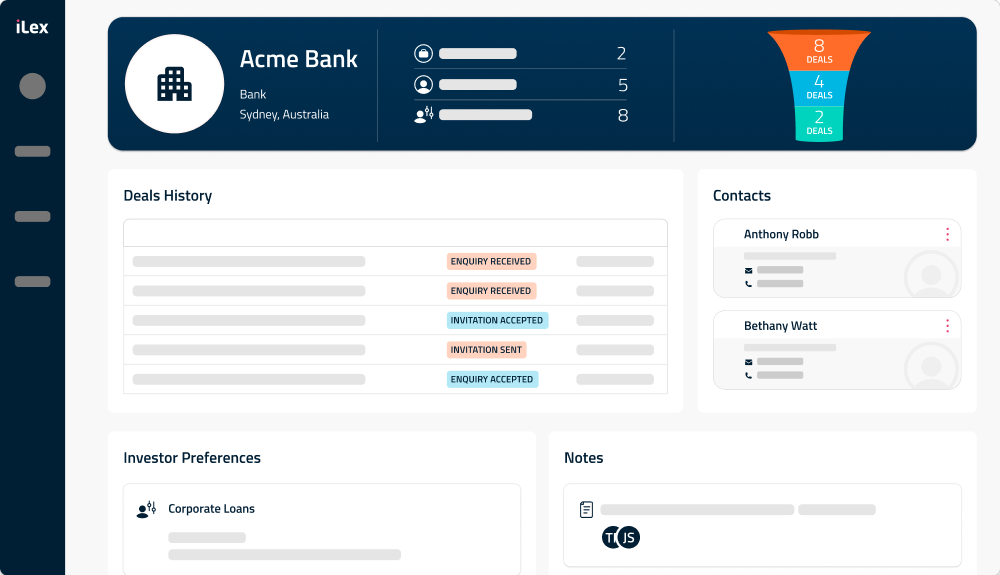

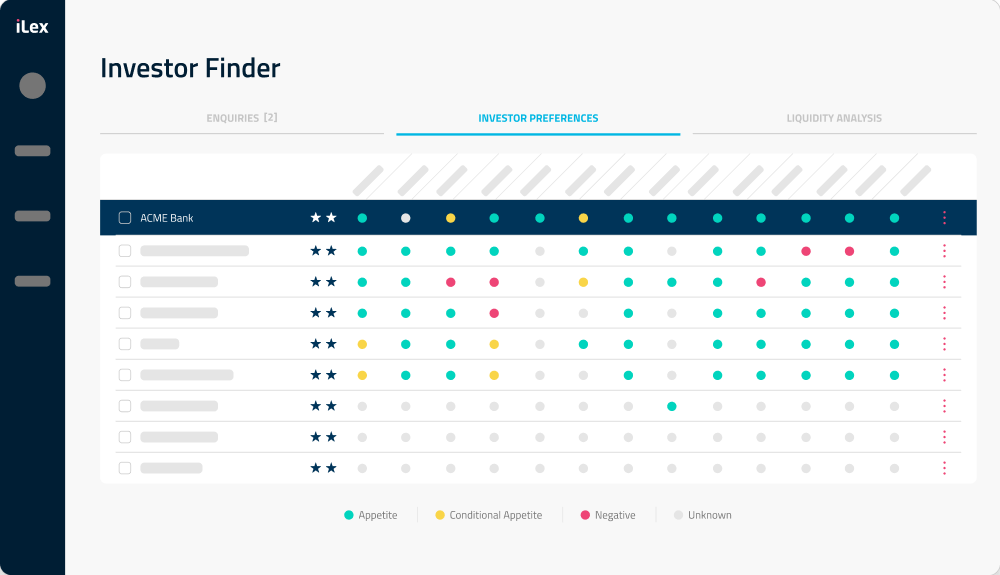

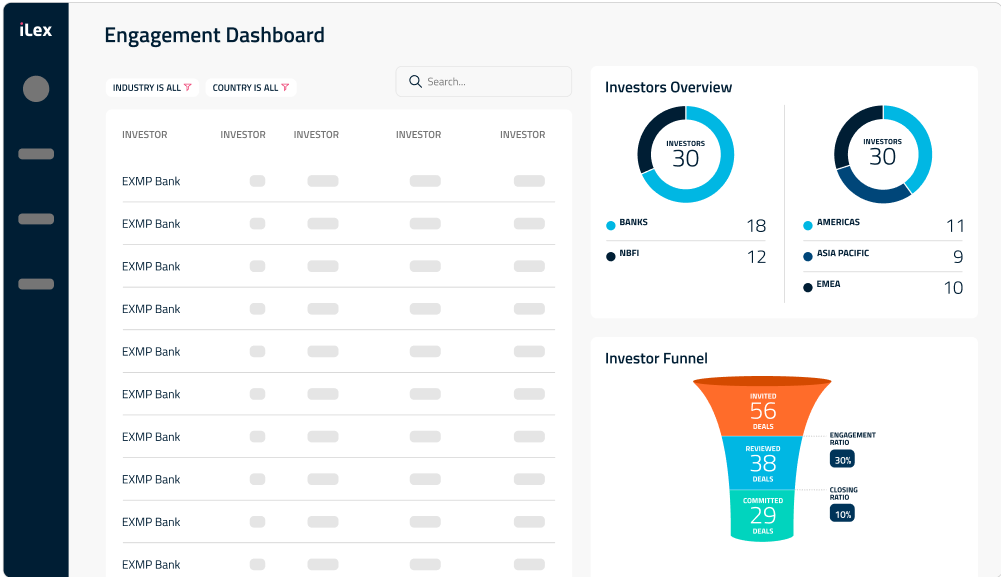

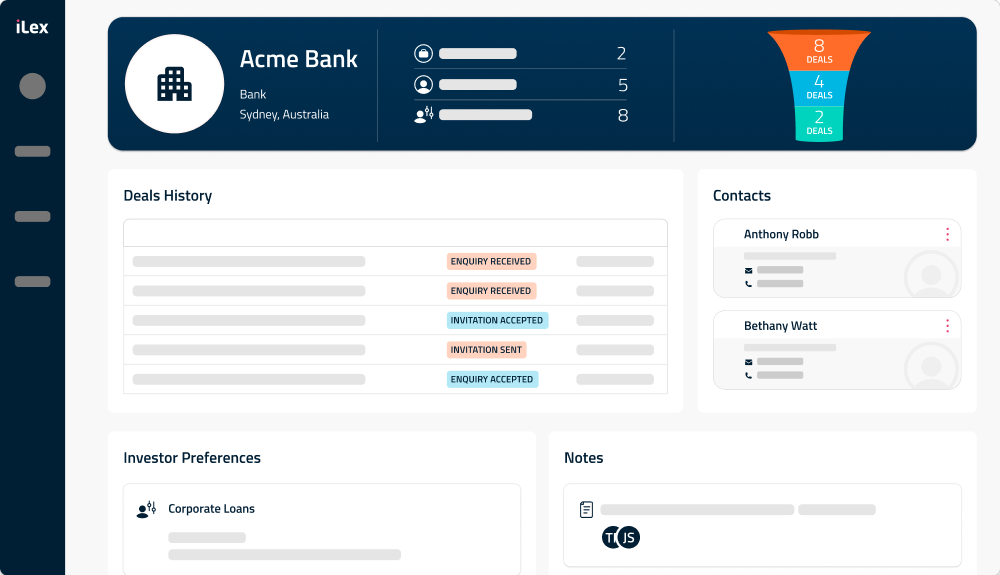

Investor 360

Our comprehensive solutions for investor intelligence, engagement and deal sites are integrated with seamless uX and connectivity on one platform.

Consolidate investor data

- Deal history

- Investor preferences

- Call notes and interactions

- Proprietary market directory

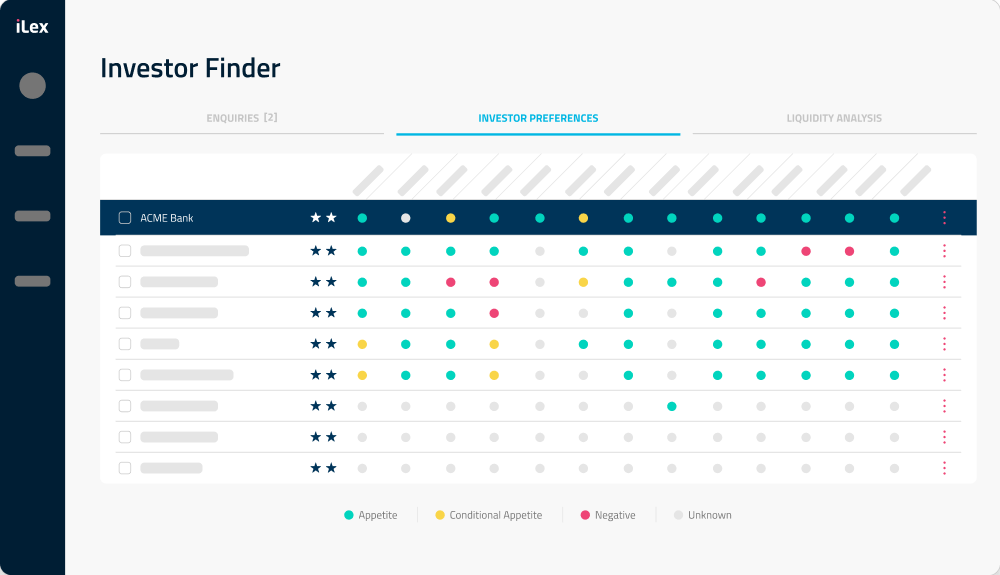

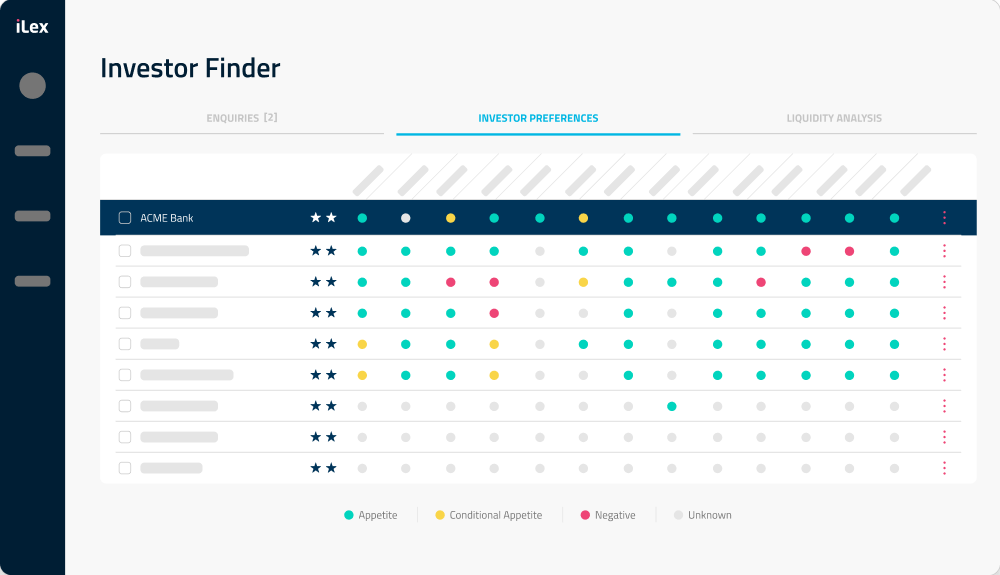

Identify relevant investors

- Inbound enquiries

- Investor heatmaps

- Investor recommendations

- Liquidity analysis

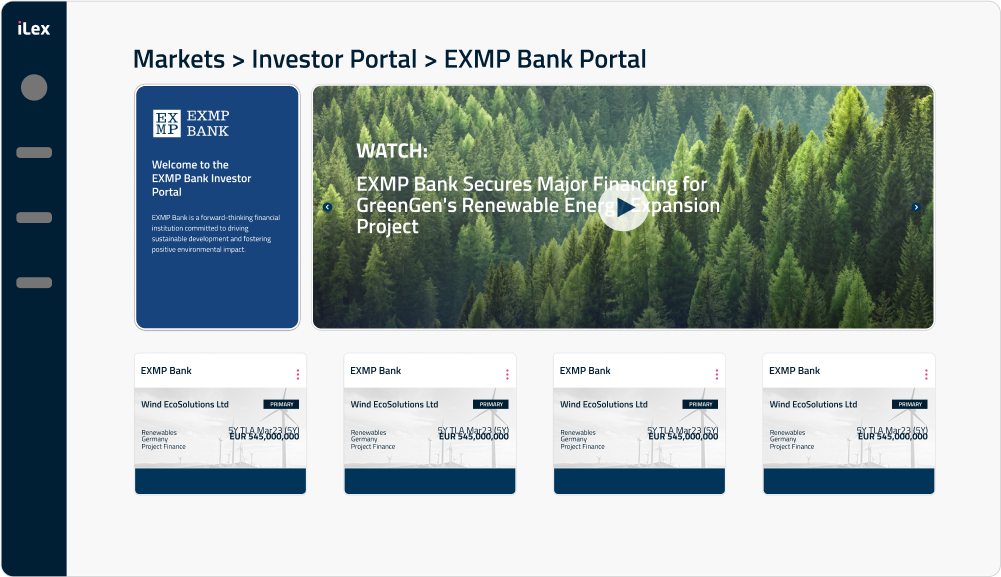

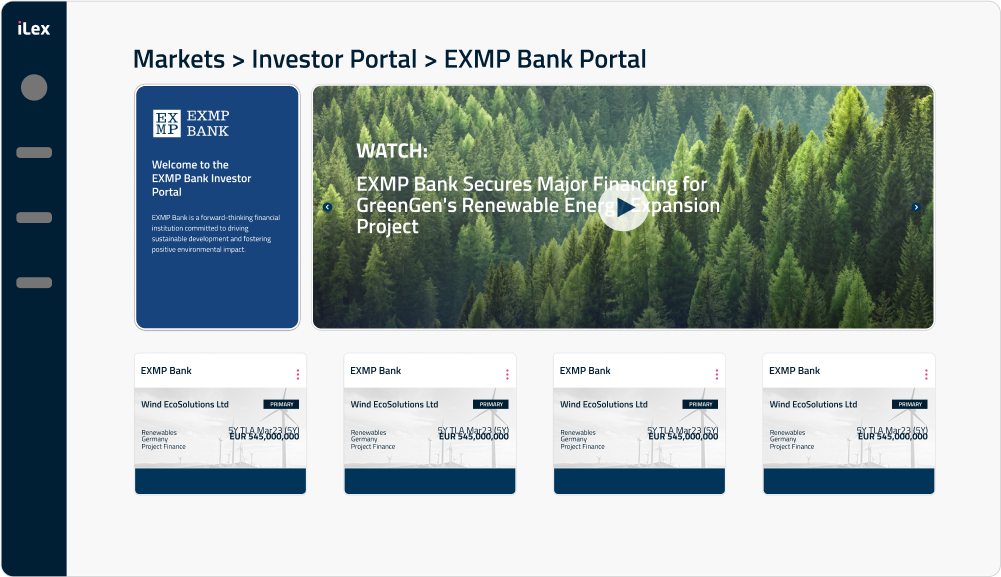

Market loan assets

- Marketplace

- Axe sheets

- Private investor portals

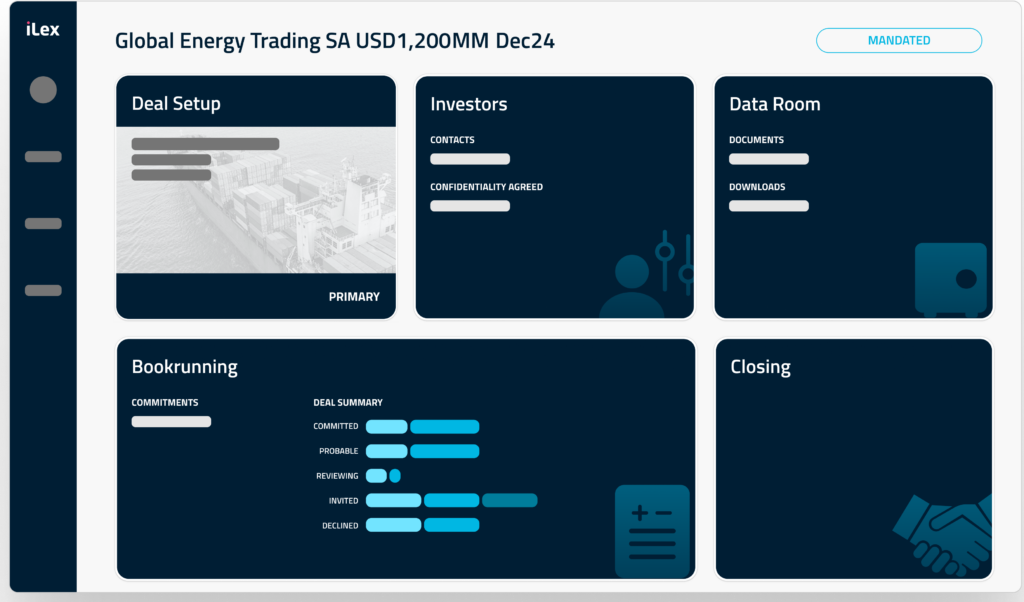

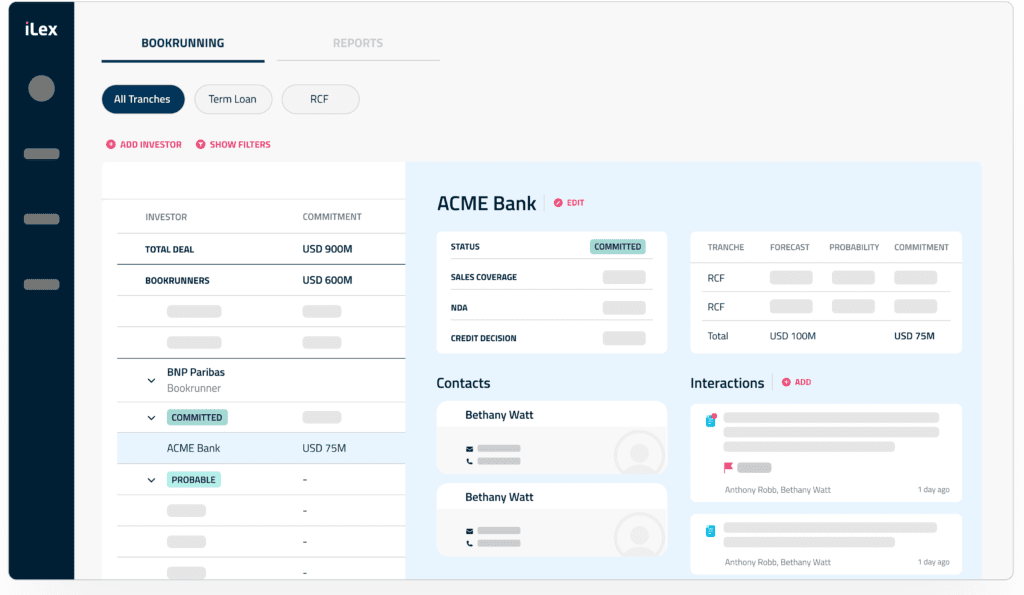

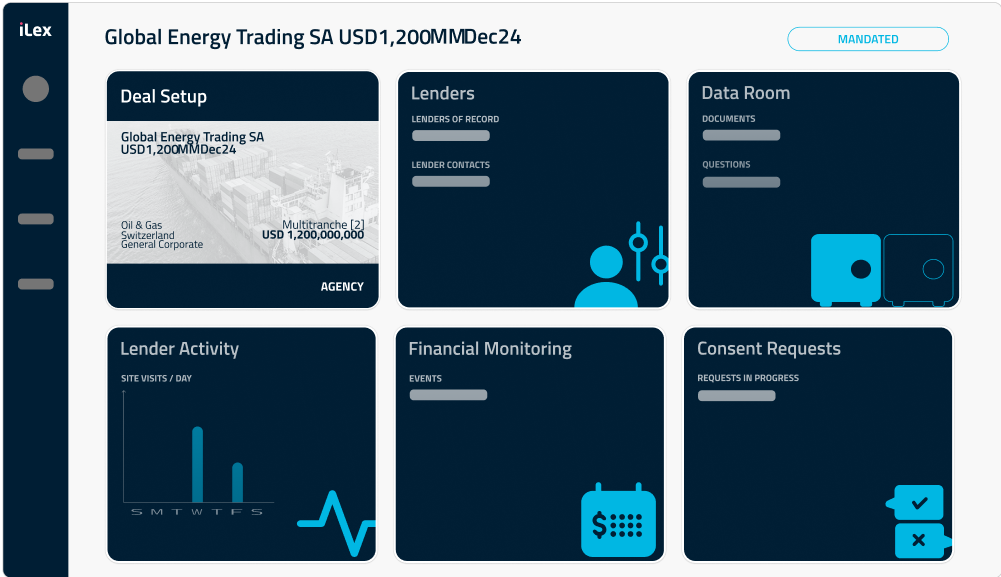

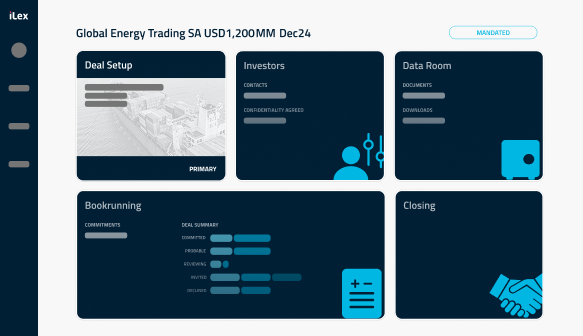

Next-gen deal sites

Run deals with our workflows that bring more productivity, more interactions, more control, and embedded intelligence.

Launch new deals

- Set up deal information in seconds

- Manage deal team and member permissions

- Select investors and send invitations

- Streaming NDA workflow

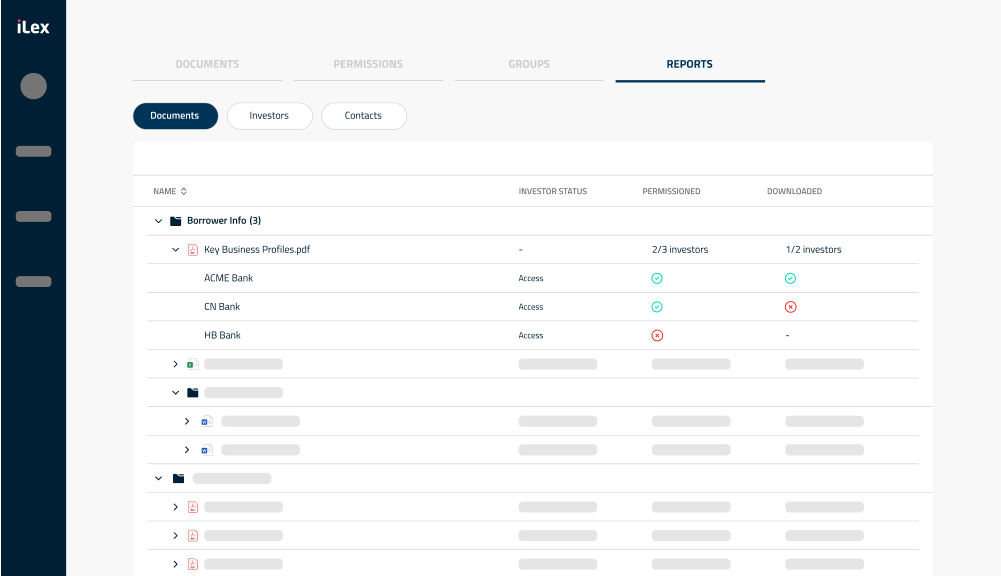

Share documents

- Modern, structured and super-fast data room

- Set and automate permissions at a granular level

- Collaborate on investor FAQ

- Monitor data room activity

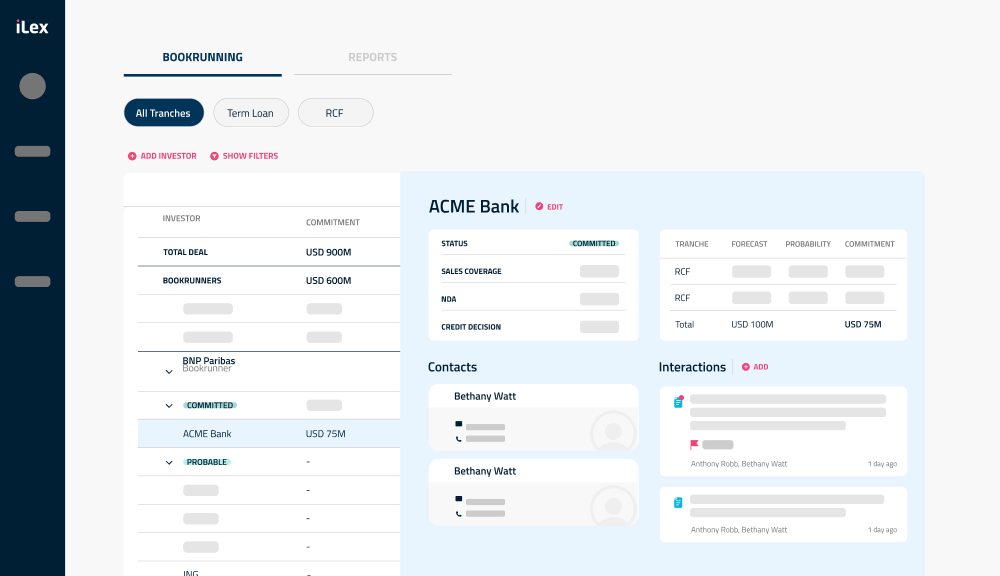

Build up investor intel

- Bookrun from interest to close

- Consolidate comms across multiple channels

- Track activity and deal progress with dashboards

- Generate dynamic reports and KPIs instantly

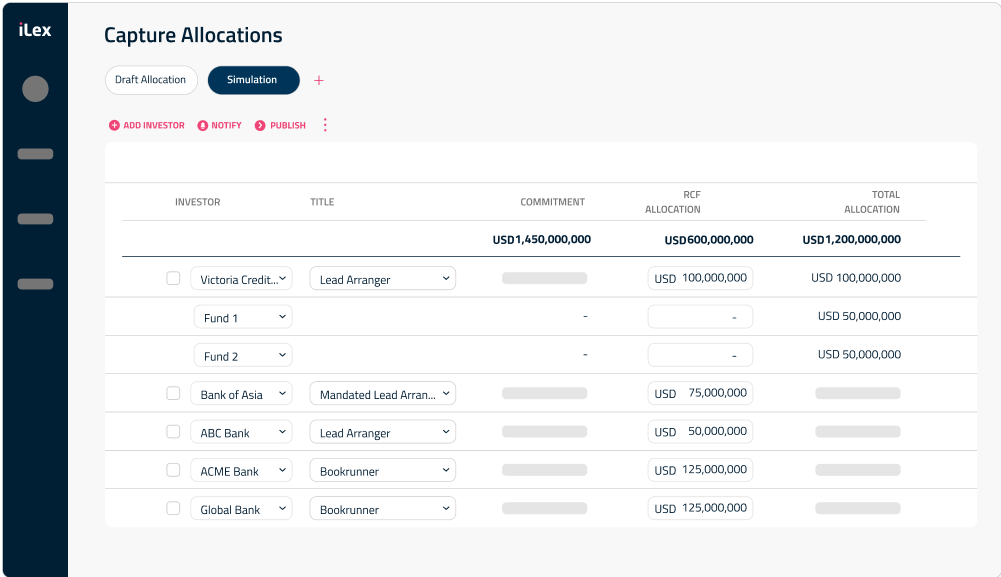

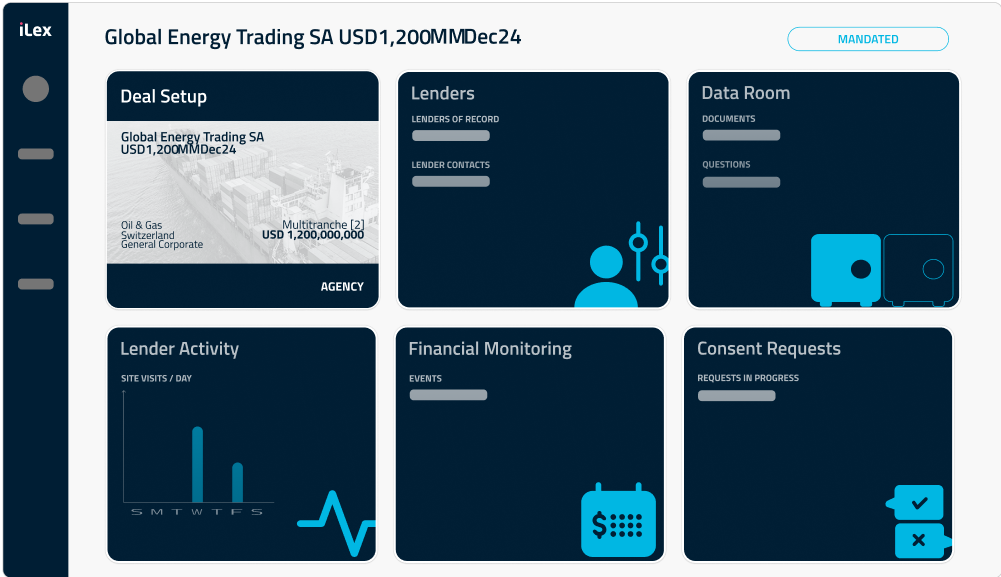

Deal 360

Centralize deal data, automate workflows, and sync seamlessly with your systems.

Book, settle & report

- API gateway

- Open architecture

- Hybrid cloud

Manage deal through lifecycle

- Origination pipeline

- Synchronise with Agency deal site

- Synchronise with Agency deal site

Manage deal progress

- Proprietary deal repository & history

- Automatically capture CRM records

- Build-in investor reports/funnel

Investor 360

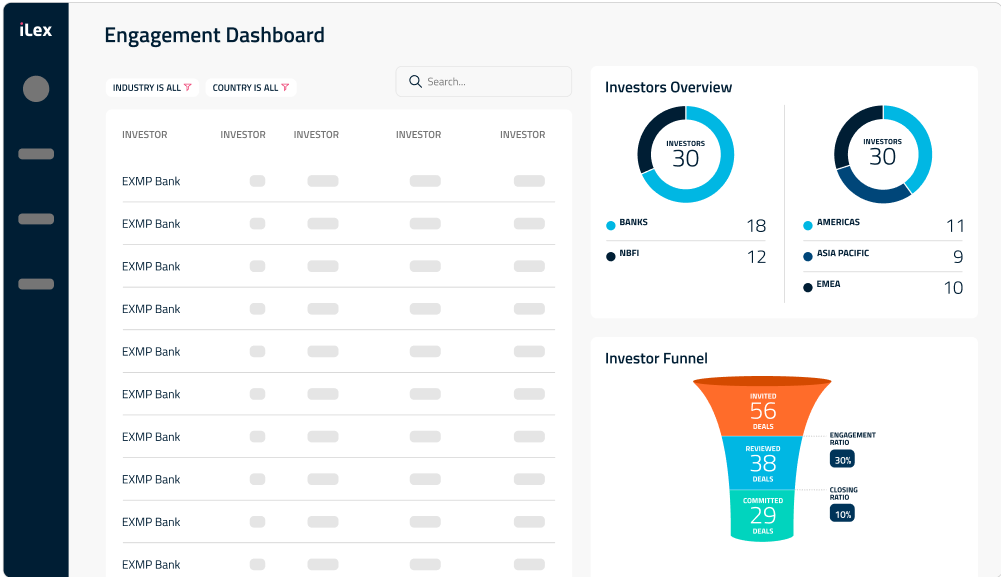

Sharpen your investor intelligence and grow your engagement

Consolidate investor data

⬝ Deal history

⬝ Investor preferences

⬝ Call notes and interactions

⬝ Proprietary market directory

Identify relevant investors

⬝ Inbound enquiries

⬝ Investor heatmaps

⬝ Investor recommendations

⬝ Liquidity analysis

Market your deals

⬝ Marketplace

⬝ Axe sheets

⬝ Private investor portals

Next-gen deal sites

Run deals with our workflows that bring more productivity, more interactions, more control, and embedded intelligence.

Launch new deals

⬝ Set up deal information in seconds

⬝ Manage deal team and member permissions

⬝ Select investors and send invitations

⬝ Streamline NDA workflow

Share documents

⬝ Modern, structured and super-fast data room

⬝ Set and automate permissions at a granular level

⬝ Collaborate on investor FAQ

⬝ Monitor data room activity

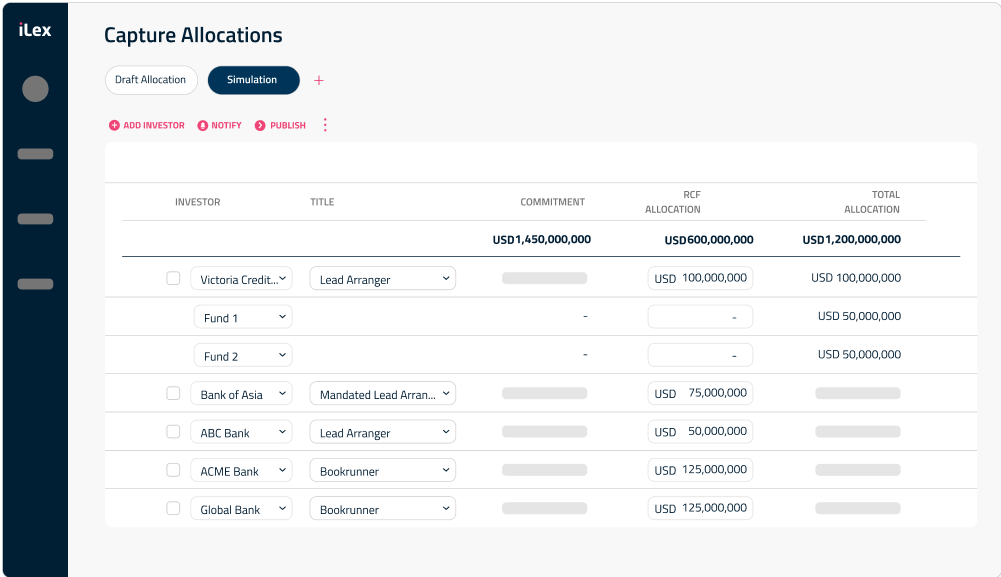

Manage deal progress

⬝ Bookrun from interest to close

⬝ Consolidate comms across multiple channels

⬝ Track activity and deal progress with dashboards

⬝ Generate dynamic reports and KPIs instantly

Deal 360

Centralize deal data, automate workflows, and sync seamlessly with your systems.

Book, settle & report

⬝ API gateway

⬝ Open architecture

⬝ Hybrid cloud

Manage deal through lifecycle

⬝ Origination pipeline

⬝ Synchronize with Secondary deal site

⬝ Synchronise with Agency deal site

Build up investor intel

⬝ Proprietary deal repository & history

⬝ Automatically capture CRM records

⬝ Build-in investor reports/funnel

Our technology edge

Our platform is built to adapt to and align with your evolving interoperability, data

management, and security demands for the long-term.

Open Architecture

Flexible integration with existing systems through our extensive APIs gateway and microservice architecture

Private Cloud

Facilitated stewardship of your data confidentiality and data flows with our hybrid cloud solution

Secured

Enterprise-grade security including SOC2 compliance, multi-factor authentication and IP whitelisting

Big Data / AI

Leverage our open-source data model and unique VDW to capture and mine ever more deal data for greater analytics, insights and compliance

Ensuring deal confidentiality and data security

Information privacy and security is a core principle of iLex’s operations. iLex stores all data encrypted, with strict IT security controls, in multiple availability zones.

Our platform ensures the strictest standards of confidentiality. Deal and client information remain private. Clients are in full control of the amount of disclosure they choose to share with counterparties.

iLex is SOC 2 Type 2 certified.